Read Time: 8 minutes

On 3rd July 2019, the Reserve Bank of Australia decided to cut interest rates further to 1% from 1.25% in the last month: the lowest level in Australian history.

Among the major economies, Australia is the only country that has cut interest rates twice in two consecutive months, while other economies such as the U.S, Canada, and the U.K have gradually lifted their interest rates since mid-2016. This may suggest that there are inherent risks in the economy that require intervention.

The cash rate is determined with the aim to achieve the three economic objectives of the RBA, namely

(1) maintain the stability of the currency;

(2) maintain full employment;

(3) and the economic prosperity and welfare of the Australian people.

Despite the economy performing firmly around the long-term trend at an annualised growth of 2.8%, the growth is trending downward in recent quarters, driven by sluggish household consumption and weak building activities, however, growth in export, non-mining business and public spending have been on the rise.

Despite the housing market, sentiment has increased in recent weeks following the election and the last month’s interest rate cut, which is reflected by higher auction clearance rates than in the past two years across major cities, however, the issues of un-affordability and high household debt remain major constraints in the housing market.

In addition, the labour market shows signs of weakness. The unemployment rate is currently sitting at 5.2%, which is higher than the RBA's objective of 4.5%; the annualised wage growth rate of 2.3% is lower than the expectation of 3%; and the number of job advertisements remains constant over the last year, despite strong population growth of 1.67% nationally.

The annual inflation rate in Australia fell to 1.3 percent in the first quarter of 2019 from 1.8 percent in the previous period, which is significantly below the RBA’s inflation target of 2-3%. This suggests that there is not enough demand for goods and services and companies are operating under full capacity.

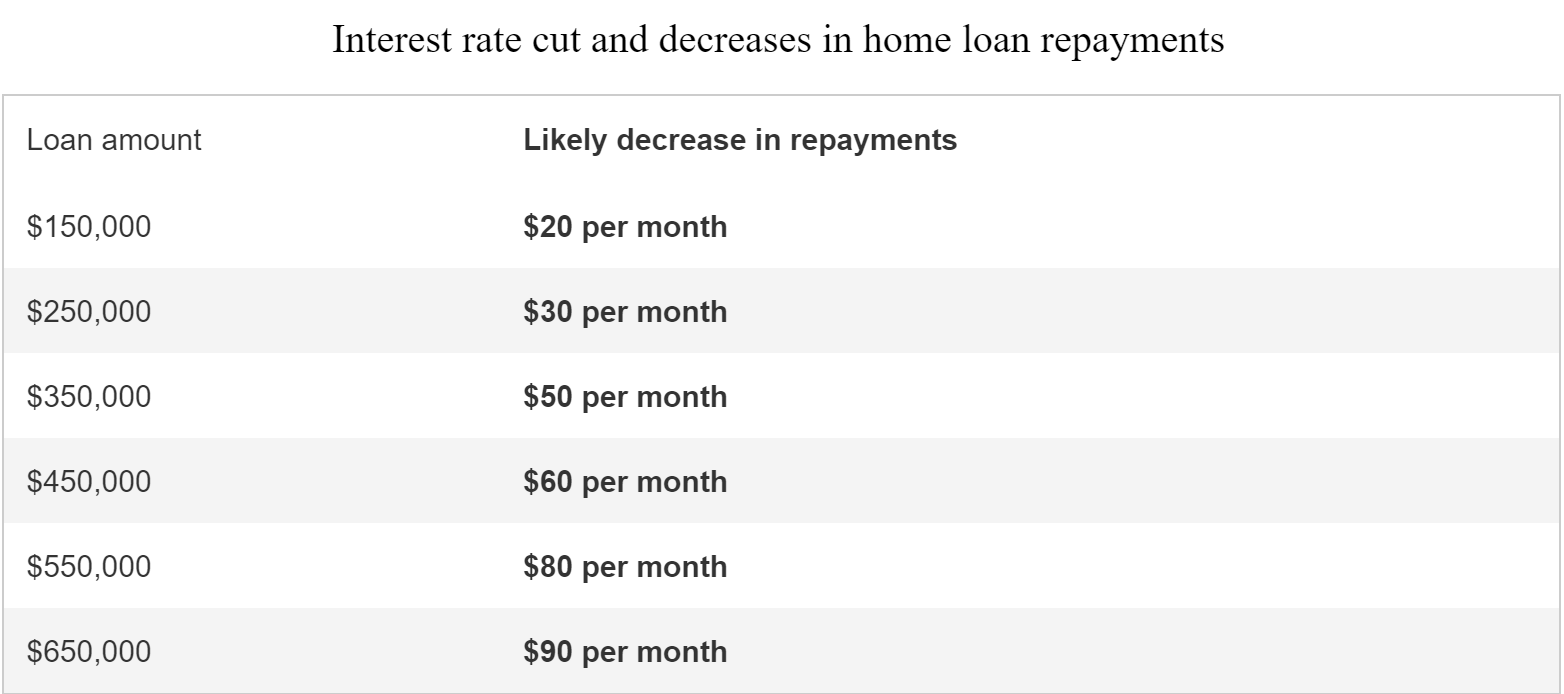

Taking into account the current conditions of the economy, the RBA has decided to lower interest rate by 0.25% to boost the economy by encouraging more hires in the labour market and lowering borrowing costs to households and businesses.

The RBA will continue to monitor the domestic and international factors to decide the monetary policy stance in its next meeting, scheduled on 6th August 2019.

Source: calculated using home loan calculator, assuming 100% passthrough the cut to borrowers.

Source: Australian Bureau of Statistics, Milk Choc’s database

Source: Australian Bureau of Statistics, Milk Choc’s database

Source: Australian Bureau of Statistics, Milk Choc’s database